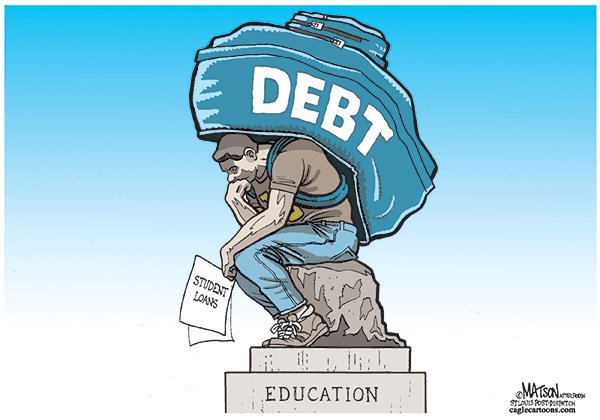

Fraudulent Student Loan Debt Relief Companies Are Preying On The Most Vulnerable Student Borrowers

A NerdWallet investigation has found fraudulent student loan debt relief companies are preying on the most vulnerable with student loans. Federal agencies dispute who’s to blame and what to do.

The CFPB and the Federal Trade Commission have closed only seven companies that have scammed consumers. The scam outfits make rosy promises to borrowers promising reduced and forgiven student loan debt.

NerdWallet discovered more than 130 student loan debt relief businesses with records of questionable or illegal behavior. State and federal documents nationwide identified companies hit by lawsuits and court actions or negative. Some of these bogus student loan debt relief companies also had owners who couldn’t manage their own debts.

NerdWallet found many of the businesses are also still fleecing borrowers. Some charge illegal upfront fees and monthly dues for debt consolidation. Scammers hijack debtors’ accounts and let payments lapse. This leads to the borrower leads to garnished wages and seized tax refunds. Borrowers have also had their credit ruined.

Read more here

Check us out on Facebook at Fight Student Loan Debt

Or Check Us Out on The Web at Student Loan Debt

Collection Defense

Do not use all of these Private Money Lender here.They are located in Nigeria, Ghana Turkey, France and Israel.My name is Mrs.Ramirez Cecilia, I am from Philippines. Have you been looking for a loan?Do you need an urgent personal or business loan?contact Fast Legitimate Loan Approval he help me with a loan of $78.000 some days ago after been scammed of $19,000 from a woman claiming to be a loan lender from Nigeria but i thank God today that i got my loan worth $78.000.Feel free to contact the company for a genuine financial call/whats-App Contact Number +918929509036 Email:(fastloanoffer34@gmail.com)

ReplyDelete